Case Study: 816 NW Market St

Driving Elements:

- Investment

- Good agent relationships

- Showing up

I helped the buyers purchase this property in 2013. As of January 2015, 60% of the buyers loan is being covered by the rent generated in the lower level apartment. In this short time, the buyer has been accumulating cash and is preparing to make another investment.

A few things worked particularly well here. First, and most critically, the buyers had done their homework and understood the potential.

When we found ourselves in multiple offers, it was helpful that I had a good working relationship with the listing agent. Because of this, the seller agreed to meet for an in-person offer presentation (I don't believe competing agents/buyers presented in person). And, at that presentation, the listing agents encouraged their client to take my client's offer.

View listing details here.

Seattle Real Estate Supply according to the cranes

Been thinking about how much the construction cranes tell us about housing inventory in Seattle. The red and white cranes to the right are building Insignia; the only significant condo project coming out of the ground. The rest of the cranes represent new jobs (commercial office) and non-owner occupied housing units (apartment buildings) in South Lake Union. Through this lens, the strong seller's market makes more sense.

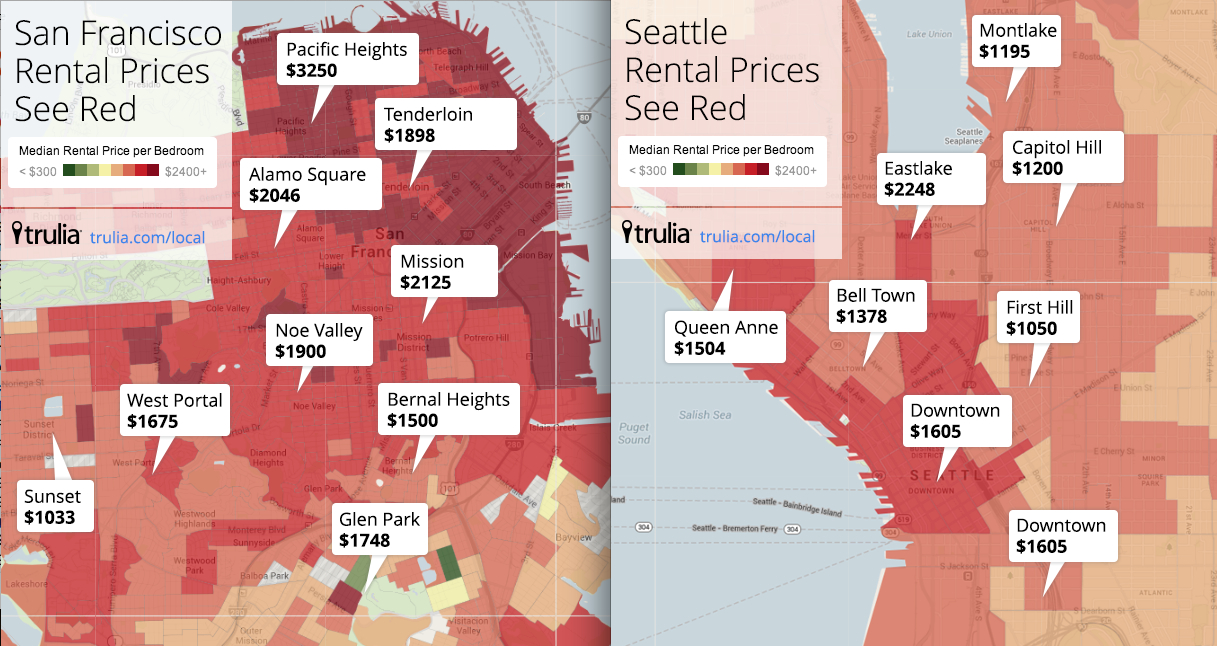

Red hot rentals: Seattle’s South Lake Union vs. San Francisco

Interesting article from GeekWire regarding residential rents in Seattle (my nowtown) as compared to SF (my hometown). It makes me wonder: Without SF-like rent control laws, do Seattle renters actually have more to fear than SF renters over the long term? Is the incentive to buy more significant here than there? If it is, at least the purchase prices are lower. And the competition, while fierce, may not be as ruthless as it is on that peninsula.

Belltown apartment building sells as tech fuels Seattle-area market

Puget Sound Business Journal

http://m.bizjournals.com/seattle/blog/techflash/2013/11/tech-effect-fuels-seattles-apartment.html

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link