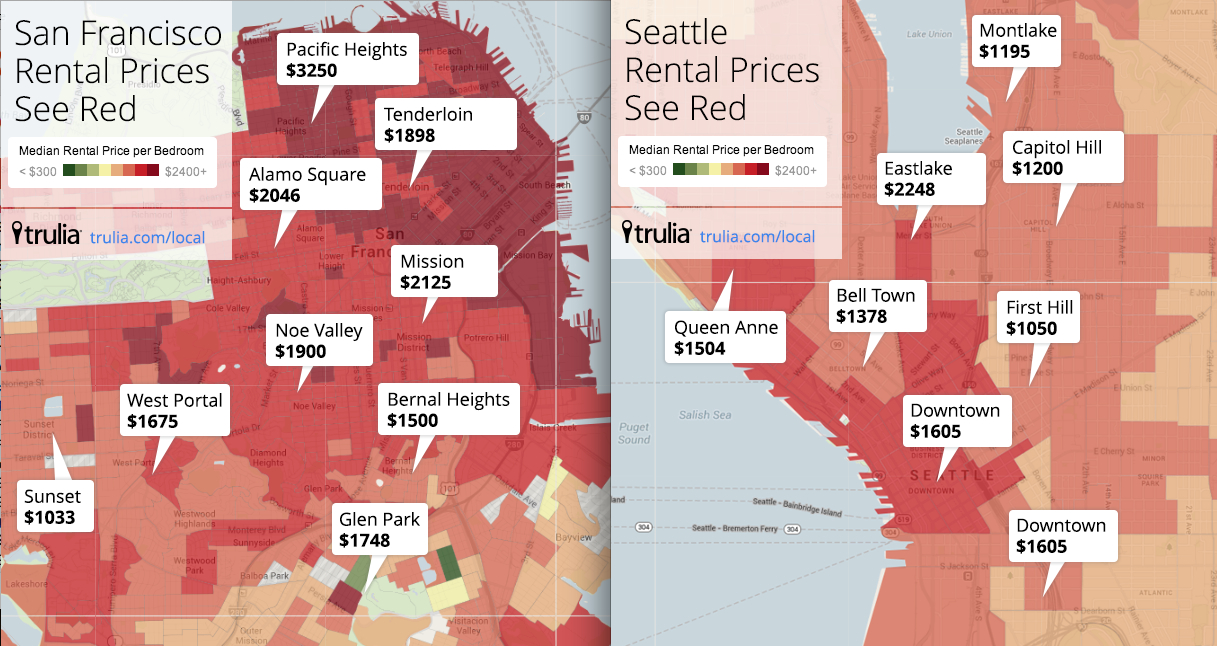

Red hot rentals: Seattle’s South Lake Union vs. San Francisco

Interesting article from GeekWire regarding residential rents in Seattle (my nowtown) as compared to SF (my hometown). It makes me wonder: Without SF-like rent control laws, do Seattle renters actually have more to fear than SF renters over the long term? Is the incentive to buy more significant here than there? If it is, at least the purchase prices are lower. And the competition, while fierce, may not be as ruthless as it is on that peninsula.

Belltown apartment building sells as tech fuels Seattle-area market

Puget Sound Business Journal

http://m.bizjournals.com/seattle/blog/techflash/2013/11/tech-effect-fuels-seattles-apartment.html

Should I wait to take action?

Q: The price is too high. Why don’t I just wait until they lower it and then take action?

Q: The price is too high. Why don’t I just wait until they lower it and then take action?

I get this question a lot. My observations: the best opportunity often seems to come when the property has been on a while at the current price. When the Seller drops the price, they are likely to dig in at the new number, and less likely to take a lower offer before giving it some time. If they manage price drops correctly, they can always keep the pressure up.

Millennials in the News

I’m seeing a lot of focus recently on Millennials.

First, I was interviewed for this article. After about thirty minutes on the phone during which I felt I said all kinds of interesting things, the reporter decided that brevity was the soul of wit and distilled my comments: http://seattletimes.com/html/homesrealestate/2022051165_hrerentersowners20xml.html#.UmVzjkc2TF4.facebook.

The longer version of what I said is that we used to have four general markets for downtown condo dwellers: committed urbanites, downsizers, 2nd home buyers, 1st time buyers hoping to use that purchase as a stepping stone into townhomes/single family homes. In the downturn, that fourth category saw their dreams dashed; there was a year or two in which we heard very little from them. Even the youths (“the two _yutes_”: http://www.youtube.com/watch?v=B1QpyGa61zs ) who didn’t purchase saw their friends/older siblings get hurt and so have come back in somewhat reluctantly and with an aversion to: total monthly housing expense higher than current rent, rental caps, potential future assessments, potential loss of view.

Then, I read an interesting article in The New Yorker, penned by a Millennial, about my hometown, San Francisco. What most took me was the full-on embrace of self-direction; of owning one’s own time, perhaps of living genuinely. A dear friend pointed out how exhausting it must be to hold three different jobs and then to have to find an unique, artisanal hobby to add to the mix. Agreed. http://www.newyorker.com/reporting/2013/10/14/131014fa_fact_heller

And finally, today’s insight from Inman News, possibly writing off the entire generation when it comes to homeownership: http://www.inman.com/2013/10/24/cant-find-work-or-save-for-a-down-payment-are-millennials-becoming-real-estates-lost-generation/ For some reason, the fear seems a bit overblown to me, but…the assertion that “adolescence actually extends to about age 25” is fun to consider.

Changing Seattle Waterfront

I get a lot of questions about the changing Seattle Waterfront (not the Big Wheel, the real estate!). Here's an informative article: http://www.djc.com/news/ae/12044999.html

Zillow report on negative equity, regionally and by age

This is interesting from last week. 1) If the numbers are relatively accurate (Q2 relative to Q1) the downward trend in underwater homeowners is a good thing. 2) Empirical evidence of why we are experiencing a shortage in supply, and 3) interesting bell curve based on age of owner/borrower; I’m guessing those numbers are due to frequency of move, appetite for risk and the high income/lower savings rate often associated with the top of the curve. "http://www.prnewswire.com/news-releases/negative-equity-falls-in-second-quarter-nearly-half-of-borrowers-under-40-remain-underwater-167166435.html?

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link